2021.7.9 by Stefan Huang(NTUB A. Professor) and Liang-Shen Simon Wang(MLNGT Master Student)

Taiwan has suffered from sky-high housing prices for years. Even during the pandemic outbreak, housing prices remain high. Local residents have been urging the Taiwan ruling party to respond to the housing problems. The following two administrative and tax reforms have been enacted on the first day of July 2021 to cool the red-hot housing market :

Pillar One– Housing Transaction Price Registration System 2.0:

This new system aims to eliminate the information asymmetry between the buyers and the sellers. Based on the new system, there are some extra transactional data which have to be registered online and open to the public :

- the right address of each transferred property

- the price of the off-plan property

- speculator who owns an off-plan property is not allowed to resell the property before the construction is finished

Pillar Two- Reform on the Special Tax Regime of the Capital Gains Derived from Sale of a Real Estate:

The capital gains from real estate transactions after the beginning of 2016 are subject to a special separate tax regime. Based on the separate tax regime, the tax payable is determined by the length of the property holding period.

- Tax scope covers income from a sale of land and/or building, an off-plan property , or a sale of company shares which over half of its net assets consist of a Taiwan real estate.

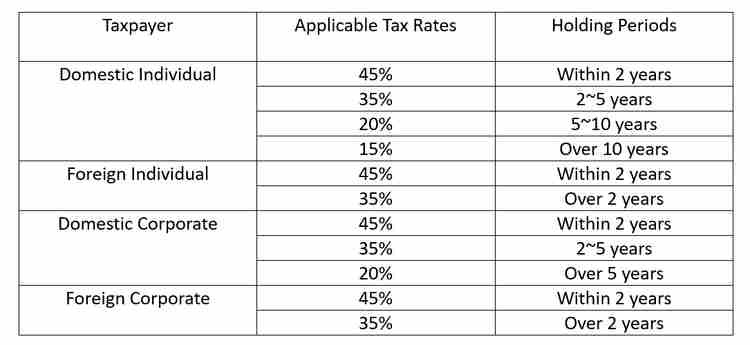

- Taxpayer is a domestic individual, a foreign individual, a domestic corporation, or a foreign corporation who engages in local real estate or special equity transactions.

- tax compliance and procedures:

- For domestic and foreign individuals, they are entitled to the”Separate Taxation”(i.e. their tax filing can be separated from the income tax). The individuals should file for the separate taxation within 30 days after transferring their property title. ;

- For domestic corporations and foreign corporations with a fixed place of business in Taiwan, they are entitled to the “Separate Taxation”. However, they should consolidate the tax filing with the corporate income tax;

- For foreign corporations without a fixed place of business in Taiwan, they can appoint a tax agent to handle the Separate Taxation and tax declaration.

- Progressive tax rates are applicable according to the length of property holding period:

台灣過去幾年一直有房價過高的問題,即便是在疫情爆發之後;高房價問題促使執政黨作出政策變革,以下是兩個立法院通過的行政與稅制改革措施,並於2021年7月1日起生效,用來抑制一直不斷高升的房價:

方針一:不動產實價登錄系統2.0:該系統旨在消除不動產買賣雙方的資訊不對稱問題,依照新規定,以下的額外交易資訊必須登錄在線上並公開:

- 交易物件的確切地址

- 預售屋交易價格資訊

- 預售屋買方在物件完工之前,禁止轉售他人。

方針二:改革不動產出售的資本利得特別稅制:自2016年起,出售不動產所獲得的資本利得適用分離課稅的特別稅制,該稅制依照持有期間長短核定應納稅額。

- 課稅範圍:出售土地與/或房屋、預售屋、公司股權(該公司超過半數的的淨資產係來自台灣境內的不動產)

- 納稅義務人:從事境內不動產、特殊股權交易的境內個人、外國個人、境內營利事業與外國營利事業。

- 納稅方法與法令遵循:

- 境內與外國個人:分離課稅(不納入綜所稅申報),且在所有權登記移轉後30天內辦理申報。

- 境內營利事業與在我國境內有固定營業場所的境外營利事業:分離課稅但與營利事業所得稅一同申報

- 境外營利事業但在我國境內沒有固定營業處所:由其指定的稅務代理人辦理分離課稅申報。

- 依照持有期間累進計稅的稅率表

(本文由台北商業大學黃士洲副教授及貿易實務法律暨談判碩士學位學程王良申碩士生一同寫作)