3.1 Comparison of 3 type of Foreign Business Entities in Taiwan

First step to start your business activities in Taiwan is to have a corporate vehicle. There are three classic options listed in Table 1. Each different type of corporate entity has its own legal characters.

Table 1: Comparison of 3 types of Foreign Business Entity in Taiwan

| Type | Subsidiary Company | Branch Office | Representative Office |

| Standing of juridical personality

|

Yes | Yes | No |

| Establishment requirement(s) | Corporate or personal certificate of the foreign shareholder

Prior Approval from Investment Commission of the Ministry of Economic Affairs(MOEA)

|

Corporate certificate of the foreign headquarter | Corporate certificate of the foreign headquarter |

| Initial working capital

|

No special requirement

but recommend > NT$ 500,000 for working VISA purpose

|

No special requirement

but recommend > NT$ 500,000 for working VISA purpose |

N/A |

| Commercial registration

|

Required | Required | Not required, but recommended for working VISA purpose

|

| Registration process | Estimated within one month if documents are well prepared

|

Estimated within one month if documents are well prepared

|

Estimated within two weeks |

| Investment Permission

|

Prior approval from Investment Commission of the Ministry of Economic Affairs(MOEA) is required

|

No | N/A |

| Business Operation | Allowed

|

Allowed | Not allowed |

| Further working capital injection | Possible options:

|

Headquarter is free to wire into branch’s account at any time and with any amount | Headquarter is free to wire into Rep office’s account at any time and with any amount to cover its local expenses |

| Labor Compliance | Subsidiary company is treated as local employer and able to hire local labor force and subject to the same labor regulations | Branch office is treated as local employer | Rep office is treated as local employer |

| Registered managing person |

|

|

|

| Corporate Liabilities | The legal principle of limited liabilities is applicable to a subsidiary company. The foreign parent company is not held responsible for the local subsidiary’s debt.

|

The Foreign headquarter shall assume all responsibilities and liabilities incurred by the branch office. | The same as a branch office |

| Value-added tax | 5% | 5% | N/A

|

| Corporate income tax | 20% from fiscal year of 2018 onward

|

20% from fiscal year of 2018 onward | N/A

|

| Taxation on dividend income | 21%, applicable, when paying dividends to foreign shareholders from 2018 fiscal year onward

(reduced to 10% if pre-approved to enjoy the tax treaty benefits)

|

No dividends withholding is required to withdraw capital or profits to the headquarter | N/A

|

| Tax on accumulated retained earnings | 5%, applied to the financial results from fiscal year 2018 onward

|

N/A | N/A

|

| Local policy benefits

|

A subsidiary company may enjoy policy benefits under the Taiwanese high-tech legislation. | A branch office generally cannot enjoy any other policy benefits under the Taiwanese high-tech legislation.

|

N/A |

Also, if your business forms (subsidiary company or branch office) are to engage in investing the stocks listed at Taiwan Stock Exchange (the “TSE”), additional registration and/or approval are needed:

- Investment in listed stock for obtaining less than 10% of total shares of a company: the foreign investor shall register at the Taiwan Stock Exchange.

- Investment in listed stock for obtaining more than or equal to 10% of total shares of company: Preliminary application to Investment Commission of the MOEA before such investment

3.2 How to decide between subsidiary company and branch office

3.2.1 Comparative Advantages of a subsidiary company:

- A subsidiary company is a legally independent entity which can function as a profit center and also an eligible object for merger and acquisition.

- The principle of limited liabilities applies to a subsidiary company. In the worst business scenario, the parent company can limit its

- Since a subsidiary company is an independent entity with its own capital, it is more flexible and capable to engage local and regional business opportunities as a fully-fledged company unit under the protection of limited liabilities.

- The parent company has more wiggle room to manage the profits earned in Taiwan, either to distribute the profits back to the foreign parent company (note: 21% withholding) or retained on the subsidiary company’s book (note: 5% retained earning tax next year).

- The parent company can manage Taiwan subsidiary company’s earnings through intra-group arrangements, such as product’s margin in purchase orders (“POs”) and royalty payments.

3.2.2 Comparative Disadvantages of a subsidiary company:

- The intra-group cash-flow and transactions between a subsidiary company and parent company may be subject to withholding tax.

- The subsidiary’s undistributed profit is subject to 5% retained earnings tax.

3.2.3 Comparative Advantages of a branch office:

- Simpler cash-flow management and intra-group transaction arrangement

- No 5% retain earning tax is applicable.

- No withholding tax is applicable when remitting profits or expenses back to its h

- A branch office may share a part of headquarters’ expenses and deduct them in Taiwan.

3.2.4 Comparative Disadvantages of a branch office:

- The profits are consolidated to its foreign headquarter which may be subject to higher corporate taxation.

- The branch office cannot become an independent profit center.

- The branch office can neither be an independent entity nor an object for merger and acquisition, because a branch is hard to evaluate and difficult to arrange a share purchase.

- The debts and liabilities occurring to the branch office are deemed as accrued to the HQ. In other words, the HQ assumes “unlimited liabilities” for everything that happened in Taiwan.

- Procedures for Registration of a Local Company in Taiwan

After obtaining a foreign investment approval from the Investment Commission, MOEA, a foreign investor shall apply for incorporation registration for the Department of Commerce, MOEA, prior to commencing its business operations. Once the business registration is completed, so is the tax registration with tax authority. Your local subsidiary company or branch office is granted with a 8-digit unique business number which also represents your VAT number.

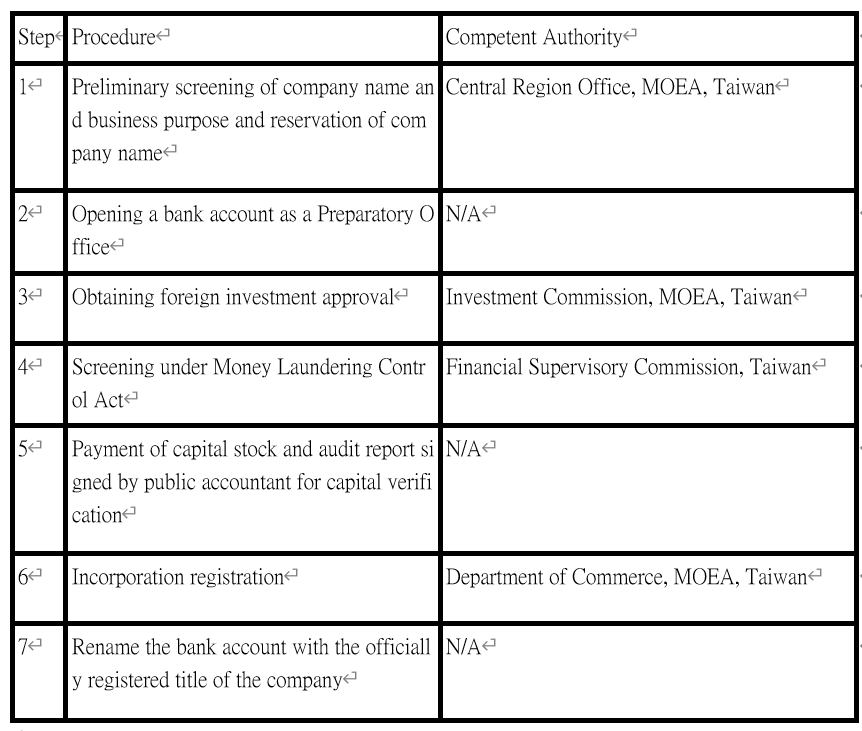

Table 2 summarizes the procedures for registration of a subsidiary company in the form of a company limited by shares (股份有限公司) in Taiwan. The procedures for incorporation of a branch office is almost identical to subsidiary company’s but skip the 3rd Step below.

Table 2: Procedures for Registration of Subsidiary Company in the Form of Company Limited by Shares in Taiwan

Notice: after the incorporation of a subsidiary company or branch office, it shall start with local operation in a certain period of time. In following circumstances, the commerce authority may order the dissolution of a company under one of the following circumstances:

- The company fails to commence its business operation after elapse of six (6) months from the date of its company incorporation registration (except where the company has made an extension registration).

- After commencing its business operation, the company discontinues, at its own discretion, its business operation for a period of more than six (6) months (except where the company has made the business discontinuation registration).

This “Doing Business in Taiwan” blog series articles is a collective work by Shih-Chou Stefan Huang (NTUB A. Professor) and Liang-Shen Simon Wang(MLNGT Master Student)

(本文由台北商業大學黃士洲副教授及貿易實務法律暨談判碩士學位學程王良申碩士生一同寫作)