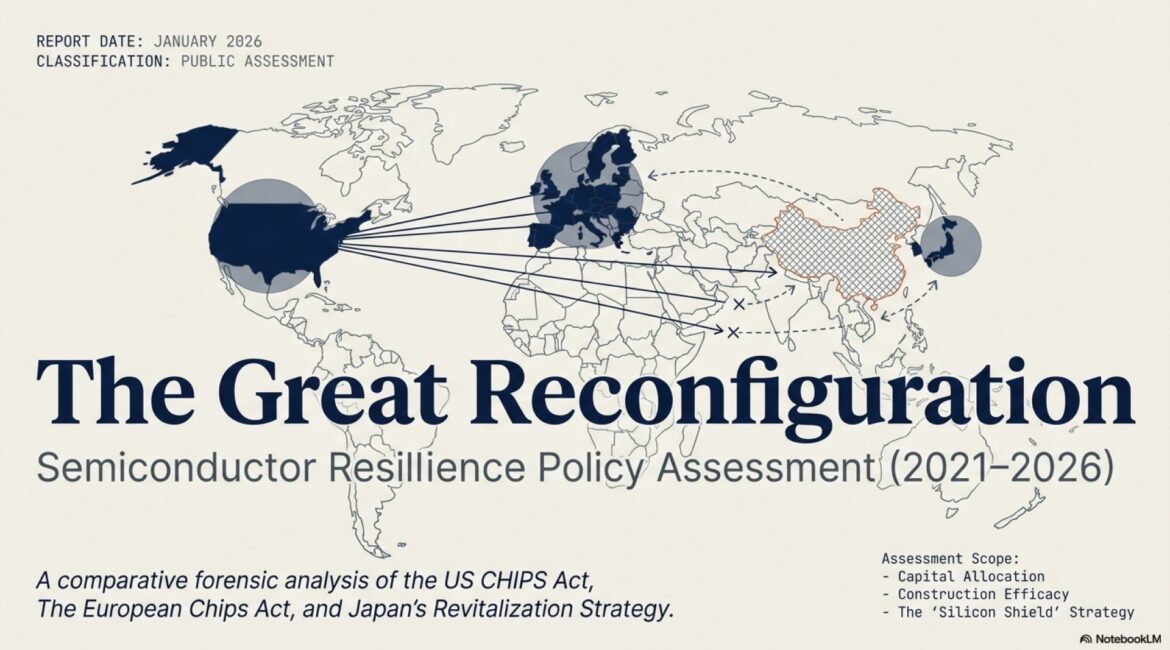

This blog article was a brief summary of 30 minutes presentation made by Prof. Stefan Huang at the Course of “Geo-poltical Economy” Aschaffenburg University in Germany on 14th Jan 2026.

The world of semiconductor manufacturing is witnessing a tectonic shift that every financial observer needs to track. We are moving away from the “Golden Age of Efficiency” and entering a period defined by Security-Centric Fragmentation. For decades, the logic was simple: produce where it is cheapest and most efficient. Today, that logic has been upended by geopolitical necessity. 📉🛡️

From Giants to Partners: A Brief History 🏛️

Historically, the semiconductor industry has been a land of giants. The United States was the first undisputed leader, followed by Japan, which eventually pivoted its strategy. This paved the way for the rise of Taiwan and South Korea—two powerhouses that chose distinct, successful paths. Taiwan dominated the Logic Chip market, while South Korea carved out a kingdom in Memory Chips. Today, as AI centers and stations proliferate globally, both types of chips have become the “new oil” of the digital economy. #AI #Semiconductors

The Geopolitical Pivot: Just-in-Case ⚡

Pre-2020, the supply chain was a clear-cut hierarchy: Taiwan and South Korea produced the high-end “brain” chips, while China handled the mature, low-level components. However, the COVID-19 pandemic and the escalating US-China conflict exposed a massive vulnerability. Global powers realized that a supply chain outside of their control is a liability. The “Just-in-Time” model has officially been replaced by “Just-in-Case.” 🛡️🤝

The USA: Building the Semiconductor Fortress 🇺🇸🏰

The United States has launched an aggressive re-industrialization campaign through the CHIPS Act. The primary objective is clear: reshore the leading-edge logic capacity (sub-5nm nodes). We are seeing the emergence of massive industrial clusters, specifically the “heavyweight” Arizona hub featuring TSMC’s fabs and the “Silicon Heartland” in Ohio led by Intel’s $20 billion expansion.

The goal for Washington is a Closed Loop. By housing fabrication, testing, and packaging within the US continent, they aim for total self-reliance. This is more than just manufacturing; it is the construction of a national security moat. #CHIPSAct #Intel #TSMC

Japan’s Speed vs. Europe’s Bifurcation 🇯🇵🇪🇺

In terms of execution, Japan is currently the gold standard. While many projects take years to break ground, the TSMC-Sony joint venture in Kumamoto was operational in record time—less than two years. Japan is leveraging its dominance in equipment and materials to “buy speed,” aiming to revive its 1990s glory by 2030. 🚄💨

Conversely, the European Union presents a tale of two cities. The Dresden project (ESMC) is a success story, focusing on the crucial automotive and industrial sectors with matured 22-26nm nodes. However, the Magdeburg project with Intel has stumbled due to financial crises and subsidy delays. This failure makes the EU’s goal of a 20% global market share increasingly difficult to achieve.

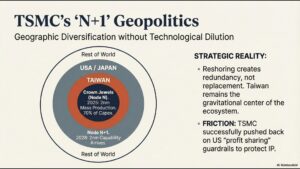

The “Made with Taiwan” Strategy 🇹🇼🤝

For investors, the most important takeaway is the evolution of Taiwan’s role. We are moving from “Made in Taiwan” to “Made with Taiwan.” While TSMC will keep its most advanced “crown jewels” (N+1 nodes) on the island, it is becoming a global partner. This shift is not just healthy; it is essential for navigating the current “Technology Curtain.” With export controls on ASML’s High-NA EUV equipment, the gap between the US-led alliance and restricted markets is widening.

The Bottom Line: Resilience is Expensive 💰⚠️

As we look toward 2030, the financial reality is that resilience has a high price tag. Fragmenting production—building separate supply chains for the US, EU, and Japan—means a double or triple investment for the same output.

This redundancy, combined with a severe Human Resources Shortage (estimated at over 67,000 workers in the US alone) and the weaponization of rare earths like Gallium and Germanium, points to one inevitable conclusion: Inflation. 📉💸

The era of cheap, ultra-efficient global chips is over. We are now paying a “security premium.” For the global economy, this is a bitter pill to swallow, but in a world of increasing authoritarian friction, it is a cost that the major powers have decided is worth paying. #MarketAnalysis #GlobalEconomy #TechTrends

中文摘要

本文是摘要黃士洲副教授在北商大德國姊妹校-阿沙芬堡科大,針對「地緣政治經濟」碩士課程所進行的30分鐘報告,所摘要內容。

大重構時代:半導體韌性政策下的全球投資新局 🏗️🌐

引言:從效率到安全——半導體供應鏈的典範轉移

當前全球半導體產業正處於一個關鍵的轉折點,我們稱之為「大重構時代」(The Great Reconfiguration)。這場從 2021 年延續至 2026 年的變革,不僅僅是技術的競爭,更是國家安全與地緣政治的博弈。過去三十年,半導體產業遵循著極致的「效率原則」,也就是在全球範圍內尋找成本最低、效率最高的地點進行分工;然而,在經歷了疫情衝擊與中美貿易衝突後,這種「及時供應」(Just-in-Time)的邏輯已徹底瓦解,取而代之的是以「安全與韌性」為核心的「以防萬一」(Just-in-Case)模式。這場重構正以前所未有的速度改變全球資本的流向與產業版圖。 #半導體 #地緣政治 #晶片法案 #韌性供應鏈

歷史回顧:巨人的演進與區域分工的瓦解

回顧半導體的演進史,美國無疑是最初的開拓者與巨人。隨後日本在 1990 年代崛起成為第二個強權,雖然其後來的領先地位有所更迭,但日本在設備與材料領域的根基依然無可撼動。接著,台灣與南韓分別在邏輯晶片與記憶體晶片領域異軍突起,兩者各司其職,支撐起了全球 AI 運算的基礎設施。然而,2022 年是一個分水嶺。在那之前,全球產能分布清晰:台、韓壟斷高端製程,中國供應成熟製程。但在當前的地緣政治張力下,各大強權意識到,如果關鍵供應鏈不在自己掌握之中,企業與國家將面臨生存危機。因此,我們看到了一場全球性的「安全中心化碎片化」現象,各國紛紛祭出重金,試圖在本土打造半導體堡壘。 🏛️📈

美國戰略:重金打造本土領先製程堡壘

美國的戰略意圖最為宏大且直接。透過《晶片法案》(CHIPS Act),華盛頓政府目標將小於 5 奈米的領先製程邏輯晶片產能移回國內。這不僅是為了振興經濟,更是為了建立一個「閉環系統」(Closed Loop)。目前,亞利桑那州已成為重量級的產業集群,台積電在那裡建設了從 4 奈米到 2 奈米的三座晶圓廠。此外,俄亥俄州的「矽谷心臟地帶」則有 Intel 耗資 200 億美元的擴張計劃。美國正透過大量補貼、貸款以及嚴格的「護欄條款」,強勢要求供應鏈夥伴將技術帶到美國本土。這種做法雖然確保了美國在極端情況下的自給自足,但也帶來了嚴峻的挑戰。

日本模式:以速度換取產業重生的先機

相較於美國的策略,日本展現了令人驚嘆的「執行效率」。日本政府的策略非常明確:用金錢換取速度。透過高達 50% 的資本支出直接補貼,日本成功吸引了台積電進駐熊本。台積電與索尼(Sony)、丹索(Denso)合作的 JASM 工廠,從動工到正式投產僅耗時不到兩年,這打破了產業運作的常規。日本此舉不僅鞏固了其在車用晶片與影像感測器(CIS)的領先地位,也為未來的 2 奈米自主研發(Rapidus 計畫)爭取到了寶貴的時間。對於投資者而言,日本的「速度策略」目前看來是各國政策中最具實效的一個,成功將其設備與材料的傳統優勢轉化為產能韌性。 🚄💨

歐盟困局:汽車產業的成功與先進製程的挫敗

然而,歐盟的表現則顯得相對分化。雖然歐盟推出了高達 430 億歐元的晶片法案,但其成效卻呈現「一勝一敗」的局面。德勒斯登的 ESMC 計畫非常成功,專注於汽車與工業應用的成熟製程,這符合德國作為汽車大國的利益。但另一方面,英特爾在馬德堡的擴張計畫則因為財務危機與補貼爭議而宣告失敗。這導致歐盟原本設定在 2030 年達成「全球 20% 市佔率」的目標在數學上已變得遙不可及。對投資者來說,歐盟的策略更傾向於「防守型」的專業化節點,而非全方位的技術領先。

台灣角色:從「台灣製造」轉向「與台灣合作製造」

在這場大重構中,台灣的角色正在發生質變。我們觀察到一個關鍵的詞彙轉變:從「台灣製造」(Made in Taiwan)演變為「與台灣合作製造」(Made with Taiwan)。雖然台積電實施「N+1」策略,確保最先進的製程與 70% 的產能留在台灣,但它同時也成為全球各國建立韌性的不可或缺夥伴。這種「矽盾」策略的地理多樣化,雖然稀釋了台灣在領先製程的產能佔比(預計 2030 年將從 90% 降至 60%),但卻在地緣政治上建立了一個更穩定、更健康的盟友關係。同時,ASML 的技術出口管制也在全球形成了一道「技術幕簾」,將美日台韓盟友與其他市場區隔開來,這對於長期技術價值的保護具有深遠意義。 🤝🛡️

隱憂浮現:人才荒與關鍵礦產的結構性束縛

然而,我們必須正視「韌性」背後昂貴的代價。首先是「人力資源短缺」的危機。光是美國,到 2030 年預計將短缺 6.7 萬名專業勞工,這不僅是數量問題,更是工作文化與技術傳承的斷層。其次是「關鍵礦產」的瓶頸,中國目前控制著全球 80% 的鎵(Ga)與鍺(Ge)產量,這些材料對於次世代半導體至關重要,供應鏈的上游依然存在嚴重的「鎖喉點」。

結論與展望:韌性是昂貴的——投資者的新常態

總結來說,韌性是極其昂貴的商品。全球生產鏈的碎片化意味著同一個產品可能需要雙倍甚至三倍的投資成本。當美國買到了「安全」,日本買到了「速度」,而歐盟退守「專業化」時,最終買單的將是全球消費者。我們可以預見,這種「冗餘配置」將導致長期性的技術通膨。對於金融市場而言,半導體不再僅僅是一個循環性產業,它已轉變為一個受政策強力驅動、高成本、高門檻的「國家戰略基礎建設」。在未來五年,投資者的目光不應僅停留在毛利率與良率,更需緊盯地緣政治下的補貼效率與跨國人才整合能力。 💰📉 #市場分析 #技術通膨 #投資策略 #ASML #台積電