Presentation for WILL Asia Pacific on March 8 2024

“WILL” is Worldwide Independent Lawyers’ League. As a member and leader of WILL TAX LAW GROUP, I presented “SAVE CLIENT’S TAXES BY USING TAX TREATY,” on March 8 2024. 3 tax treaty related cases were shared during that presentation.

- A Taiwanese resident owns a office in Japan and leases it to a Japanese company for monthly rent of ¥1 million.

- A German online match-making services company receives subscription fees from Taiwanese consumers.

- A English corporate group is contracted to provide an equipment and install it in Taiwan.

The first case of rental income derived from Japanese office can be explained in more details.

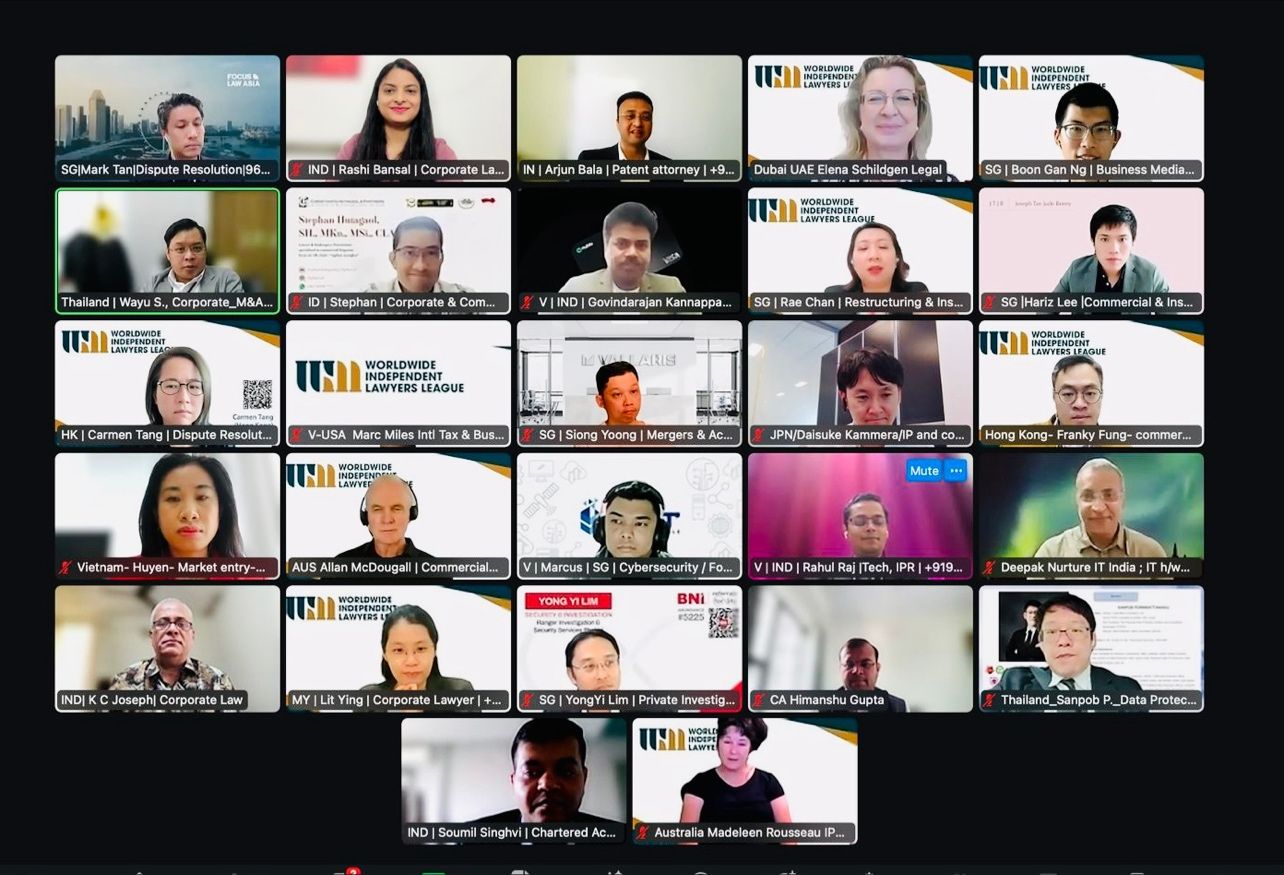

The participation of WILL Asia Pacific Monthly Meeting on March 8 2024

How is the annual rent income of ¥12 million taxed in Japan and Taiwan?

The following descriptions are colaborated with @David Chou of Eternity Law Firm. Here is his contact on LinkedIn.

1. Taiwan-Japan Tax Treaty says: Immovable Incomes may be taxed by local country

Taiwan and Japan entered into a tax treaty, which is effected since June 2016. Article 6 of that tax treaty regulates, “Income derived by a resident of a Territory from immovable property (including income from agriculture or forestry) situated in the other Territory may be taxed in that other Territory.” In other words, when Taiwanese resident owns and derives income from an immovable located in Japan, Japan has the right to tax that income.

2. Japan’s tax right on immovable incomes does not exclude Taiwan’s

The wording of Paragraph 1 of Article 6 of Taiwan and Japan Tax Treaty – “Income derived … from immovable… may be taxed in that other Territory,” literally does not preclude Taiwan from taxing the same income derived from Japanese immovable. If we apply this rule to the case of Taiwanese resident having monthly rent of ¥1 million, Taiwan may tax that rent income again after Japan taxes it . It seems Japan and Taiwan both tax that ¥1 million rent. Would it result in “doulbe taxation”? Typically, the answer is negative for two reasons: Taiwan’s tax rates on foreign incomes and the foreign tax credits awarded by tax treaty.

3. Japanese income taxation on immovable incomes owned by non-residents

Under Japanese income tax regulations, foreign residents are required to file an annual tax return if they have any income derived from Japan. Failure to file a personal income tax return may result in the acceptance of the withholding tax. When paying rent to a foreign resident lessor, the Japanese tenant company must withhold 20.42% of the rent amount. The tenant company withholds ¥204,200 from the monthly rent of ¥1 million and sends it to the Japanese tax administration. The remaining ¥795,800 is then transferred to the Taiwanese lessor’s designated account.

Although a Taiwanese lessor is required to file personal income tax returns for rental income derived from Japan, they are also eligible to claim allowances, expenses, and deductions against the rental income. The rental income will then be subject to applicable income tax rates ranging from 5% to 45%. If the final annual net income from leasing the office is less than ¥6.95 million, it will be taxed at less than 20%, and the Taiwanese lessor is entitled to a refund of part of their withheld taxes.

Article 22 of the Taiwan-Japan Tax Treaty states that the personal income tax paid by a Taiwanese lessor after declaring rental income in Japan can be converted into a foreign tax credit. This credit can then be deducted from the Taiwanese income tax payable. Failure to file a tax return in Japan would make it difficult for the Taiwanese lessor to claim the withheld 20.42% of rental income as eligible foreign tax credit later in Taiwan.

4. Taiwanese personal foreign incomes only subject to 20%

Taiwan follows a quasi-residence principle for personal income taxation, which scope includes incomes earned both domestically and overseas. A tax resident in Taiwan must report all incomes earned locally and overseas during a calendar year. However, foreign-sourced incomes are subject to a special tax threshold and a flat tax rate of 20% in Taiwan.

To calculate the ¥12 million annual rent earned by a Taiwanese lessor from the office in Japan, the rental income can first either be netted against the actual expenses incurred or directly applied at an expense/income ratio of 43/57. The remaining rental income, which is approximately 57% of ¥12 million annually, is subject to a tax threshold of around ¥30 million for foreign and domestic incomes combined. Any amount exceeding that tax threshold is then subject to a flat rate of 20%.

5. Ordinarily, the rental incomes from Japan would not result in taxable incomes in Taiwan

Unless the Taiwanese lessor has multiple high foreign-sourced incomes, the annual rent income of ¥12 million would not exceed the tax threshold for overseas incomes. Even if the annual rent income of ¥12 million is combined with other foreign-sourced incomes and exceeds the tax threshold, the Japanese 20.42% withholding tax or the actual income taxes paid in Japan would function as foreign tax credit or a tax shield, which should be larger than 20% of the flat tax rate applicable. Therefore, the rental income received by the Taiwan lessor from the office in Japan is actually tax-free for him in Taiwan.

Friendly Advices to Cross-border Investments

1. Pay Attention to Double Taxation and Tax Treaty when Creating Finance Model

As previously stated, tax treaties aim to eliminate unnecessary double taxation and maintain cross-border investments as neutral as local ones. Double taxation by both the investor’s resident country and the destination country can decrease profitability or even ruin the entire investment. Therefore, when creating a financial model for any international investment, it is important to consider the risk of double taxation and how to avoid it by utilizing treaty exemptions.

Also a friendly reminder: most of the benefits stated in tax treaty have to be properly filed and then approved by local tax authority.

2. Since Tax Matters, the consultation with Local Tax Expert is a Must

I have demonstrated a case with simple facts: a Taiwanese lessor owns an immovable property in Japan and receives monthly rent of ¥1 million. However, analyzing the tax burdens on both sides of Taiwan and Japan can be far more complicated. In this case, it may concern the Japanese and Taiwanese personal income tax laws, different ways to calculate rent incomes, withholding taxes and forein tax credits granted under the tax treaty. Not to mention the local tax practices, administrative procedures, and the qualification of invoices and receipts can much further complicate matters, making it essential to consult with local tax experts for proper management.