- Taiwan has enacted the Controlled Foreign Company(CFC) and Place of Effective Management(PEM) regime in 2016. However, due to complicated issues, these CFC and PEM regimes are not implemented yet.

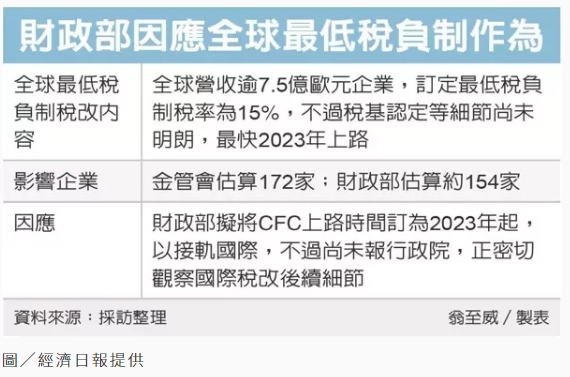

- Since the OECD/G20 had pushed the agreement of Two-Pillar proposal and expected to implement the GloBE (Global Minimum Taxation) from 2023, a strong attention has been cast on the impacts that might be brought to Taiwanese international corporations.

- The concerned impacts from Taiwan’s perspective are 1. increase of foreign tax costs and double taxation; and 2. potential loss of Taiwan’s tax revenues from the Taiwanese international corporations.

- According to estimation of Taiwan MOF, 154 listed companies now fall into the scope of GloBE, which thresholds is annual global revenues more than 750 million Euro.

- To address the impact and avoid possible tax revenue losses from the implementation of GloBE, Taiwan’s MOF says, it will amend the Corporate Minimum Income Tax regulations and begin the implementation of Taiwan’s CFC regime on the first day of 2023.

Taiwan’s News report source:

接軌國際 CFC拚2023年上路 LINK 2021-11-14 經濟日報 / 記者翁至威/台北報導