Topics of Part 1

- Why Taiwan?

- The Economy Status Quo

- Why Taiwan

Taiwan has an important position in the global economy. It is a top player in the world’s information and communication technology industry; especially in the semiconductor manufacturing as well as a major supplier of key components across the other industrial spectrum. Taiwan has been an export oriented economy since the 1970s. In 2020, it ranks the world’s 15th largest exporter with US$347 billion worth of merchandise. Taiwan’s GDP per capita reached US$28,306 in the year 2020, which if measured with purchasing power parity would rival that of Austria and Sweden.

Taiwan ranks World’s 15th Exporter, Photo credit to CNA

Taiwan is a democratic nation of 23 million well-educated people and has an open, efficient, and high-tech based economy. Thanks to its proactive public health management and border control, the Covid-19 pandemic has had much less impact on Taiwan’s economy and people’s daily life since early 2020. Now with more and more vaccines available, Taiwan is expected to reopen its market to the world.

Taiwan starts mass vaccination campaign since May 2021

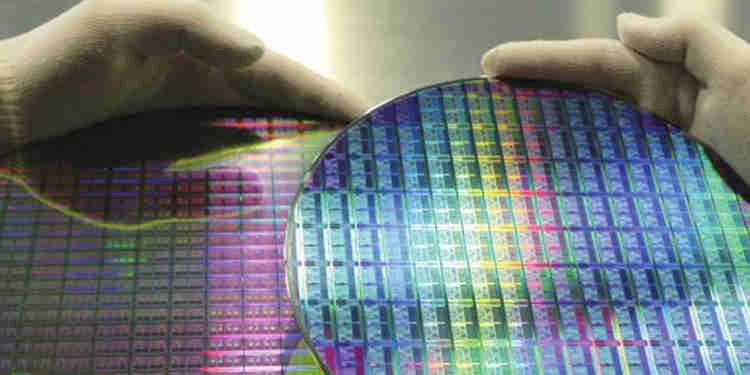

The legal and regulatory environment of business in Taiwan is also friendly to foreign investors. Industrial clusters in Taiwan may be a very good example. Industrial clusters in Taiwan are well developed and are eligible to be considered as the preferential treatment by the government. The information hardware production industry that mainly locates at “Science Parks” may be the most renowned instance, which already makes Taiwan the world second-largest producer in such industry. The semiconductor foundry, semiconductor packaging and testing, and IC design industries in Taiwan are world-famous as well. Like Taiwan Semiconductor Manufacturing Company Limited (TSMC), the biggest and most efficient chip maker in the world. The industrial developments are accompanied by government policies well-arranged to lure foreign investment and expert professionals to Taiwan.

TSMC is leading on semiconductor techs and first one to step into mass production of 2nm generation. Photo credit to CTEE.com.tw

- The Economy Status Quo

Taiwan’s trade situation has improved since 2016, and the economy constantly expands even during the COVID-19 pandemic. The economic growth is 2.73% in 2019 and 3.11% in 2020. Though there is an Alpha variant breakout in May 2021, Taiwan is expected to contain and mitigate it successfully. According to “The Economist”, this will allow real GDP to grow by 5.7% in 2021, owing mainly to strong global demand for Taiwanese semiconductor chips.

In July 2013, Taiwan signed an economic cooperation agreement with New Zealand. This is Taiwan’s first time to sign an economic cooperation agreement with a member of the Organization for Economic Cooperation and Development (OECD). An economic partnership accord was also inked with Singapore in November the same year. The accord has made Taiwan’s first such pact with a trading partner in Southeast Asia. Both agreements go beyond WTO requirements.

Well-developed transportation systems extend to all ends of the island, meanwhile, the links connecting Taiwan to all other countries are supported by seven international harbors and four international airports.

Taiwan has a high speed rail (Japanese Shinkansen) system which travels at 300+ kph among big cities. Photo credit to KLOOK.com

Furthermore, Taiwan is also known for its high quality labor force. Not only the well-trained blue-collar workforce which has been cultivated since the “Taiwan Miracle” years but also white-collar workforce is also emerging in Taiwan due to its robust education system which makes over half of the current labor force in Taiwan with a bachelor’s degree or higher educational background.

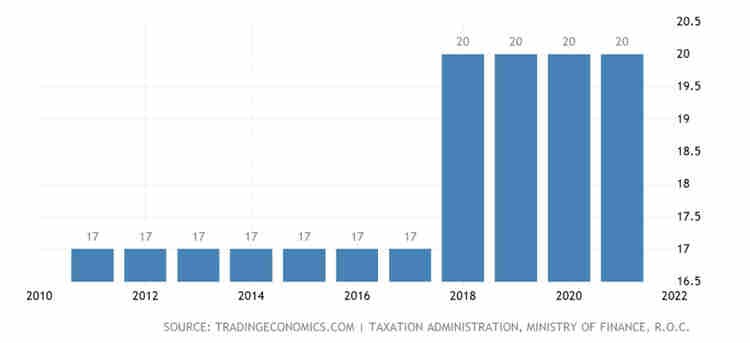

Taiwanese tax system differs from similar business attractive jurisdictions with its relatively favorable and lower tax rates. Corporate income tax rate is 20% and relevant laws prescribe numerous exemptions and deductions.

Taiwan’s Corporate Income Tax Table from 2010 to date. Photo credit to tradingeconomics.com

This “Doing Business in Taiwan” blog series articles is a collective work by Shih-Chou Stefan Huang (NTUB A. Professor) and Liang-Shen Simon Wang(MLNGT Master Student)

(本文由台北商業大學黃士洲副教授及貿易實務法律暨談判碩士學位學程王良申碩士生一同寫作)