by Stefan Huang, 2021/5/28

VP of Wetec International Accounting Firm

Associate Professor, NTUB

- Work Permit(WP)

- Alien Resident Certificate(ARC)

- Housing

- National Health Insurance(NHI): after an operating Branch office is established, the expatriate can be insured as resident in Taiwan and employee of that Branch office. His wife, children and close relatives can also be insured as dependent relatives. The NHI system can cover most of expatriate’s medical needs in Taiwan.

- Personal Tax Filing:

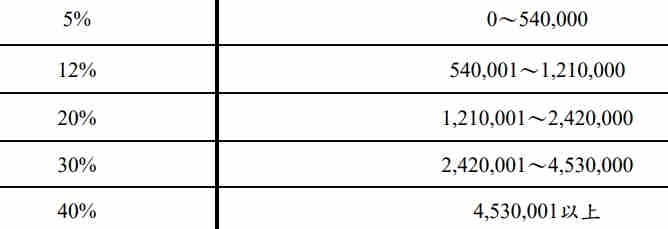

- individual tax rate: Taiwan has a progressive individual tax rate applicable to tax resident’s net taxable income. See this table (number in NTD for tax year 2020):

- rental allowance of NTD120,000: Though Taiwan Income Tax Act has annual rental deduction of NTD 120,000(ceiling amount, no more), in practice, Taiwanese individual landowners/lessors are not willing to permit their lessees to claim rental deduction. Because the lessee’s claiming of expense will result in paying more taxes on lessors’ side. However, such uncomfortable local tax practice won’t increase or affect the expatriate’s tax payable. Reason (1): The annual allowance is only limited to the amount of 120,000 for the whole tax year, not according to the actual rent paid. Reason (2): The expatriate still enjoys total deductions and exemptions amount to NTD 408,000( 616,000 with spouse) in 2020. This annual rental deduction of 120,000 can then be actually replaced by the above combined tax free amount of NTD 408,000. Only in an exceptional circumstance, which like the expatriate suffers a grave disease and pays a large amount of medical bill then the 120,000 annual rental deduction will help Thijs by slightly decreasing tax payable.

- Additional allowances paid by the foreign employer to the employees: If the expatriate’s local rent, utilities bills and travel allowances were directly paid by foreign employer, then that payments are employer’s local operating expenses. However, if these expenses are paid directly to the expatriate as additional allowance, these amount will be included in his personal salary incomes. That’s because Taiwanese tax regulation do not have a special exemption for such employee’s living allowance. The only solution is the lease contract to be signed and rent be paid by the employer (HQ or local branch, subsidiary). However, most of the local individual lessors are reluctant to contract with any corporate body because of his personal tax concerns.

- Taiwan provides special tax benefits to attract high ranking white collar to work in Taiwan. The tax benefits have a threshold of annual salary more than NTD 3 Million.