Crypto Assets in the Eyes of Taiwanese Authorities

Proposed divided regulation of crypto assets

Different perspectives and understanding of different authorities

- 1. Financial Supervisory Commission and Central Bank: These two agencies aim to keep the financial market in order and protect investors. It seems quite reasonable, as mentioned above, that before any effective regulation, these two agencies hold a dubious attitude towards crypto assets and consider them as highly unstable and speculative investment vehicles.

- 2.Ministry of Justice: This agency is tasked with being the gatekeeper of anti-money laundering and anti-corruption. After including crypto exchanges in the AML regulations in 2022, the MOJ is expanding the scope to declare the personal assets of high-ranking officials in cryptocurrencies,[FN3] and if an official fails to comply accordingly, a huge fine would be imposed. Moreover, on 2nd May 2023, MOJ launched an public auction of a “cold wallet”, which was confiscated during a raid on a scam syndicate and contained 31,355 units of USDT. [FN3.1] This news may mean that the status of crypto assets is no different from that of other physical assets from the Department of Justice’s law enforcement perspective.

- 3. Ministry of Digital Affaires:The crypto assets other than currencies and investment purposes are regulated by the MDA. The typical asset types here are NFT and IP address. The Minister of MDA has expressed the opinion that the crypto assets they regulate are not always as risky as the FSC and central banks claim. A more flexible legislative stance may strike a balance between innovation and consumer protection. [FN4]

- 4. Criminal Courts: Cryptoassets, particularly bitcoins, have been exploited as a popular means of payment for drug trafficking and money laundering,[FN5] and cryptoassets are recognized as a type of valuable property eligible for forfeiture of criminal proceeds,[FN6] and meet the accepted deposit requirement for purposes of bank crime.

- 5. Civil Courts: Taiwanese civil courts have long recognized cryptoassets, particularly bitcoins, as valuable and eligible objects for purchase contracts and loans for consumption.[FN7]

FN1:See https://www.gov.uk/government/publications/economic-crime-and-corporate-transparency-bill-2022-factsheets/factsheet-cryptoassets-key-terms-and-definitions

FN2:See central news agency 2023/3/19 : https://www.cna.com.tw/news/afe/202303190009.aspx

FN3:See MOK Agency Against Corruption: https://www.aac.moj.gov.tw/media/311187/%E6%B8%85%E5%BB%89%E5%9F%B7%E6%94%BF%E5%9C%8B%E9%9A%9B%E8%82%AF%E5%AE%9A-%E8%99%9B%E6%93%AC%E9%80%9A%E8%B2%A8%E8%AA%A0%E5%AF%A6%E7%94%B3%E5%A0%B1.pdf?mediaDL=true

FN4:See MODA news release: https://moda.gov.tw/press/background-information/3311

FN5: See Supreme Court Criminal Decision 111 Taisan 5621, https://judgment.judicial.gov.tw/FJUD/data.aspx?ty=JD&id=TPSM,111%2c%e5%8f%b0%e4%b8%8a%2c5621%2c20230104%2c1

FN6: See Supreme Court Criminal Decision 111 Taisan 5556, https://judgment.judicial.gov.tw/FJUD/data.aspx?ty=JD&id=TPSM,111%2c%e5%8f%b0%e4%b8%8a%2c5556%2c20230412%2c1

FN7:See Tainan District Court Civil Decision 106 Shu 1907 and Supreme Court Civil Decision 111 Taishan 232, https://judgment.judicial.gov.tw/FJUD/data.aspx?ty=JD&id=TPSV,111%2c%e5%8f%b0%e4%b8%8a%2c232%2c20220223%2c1

台灣主管機關眼中的加密資產

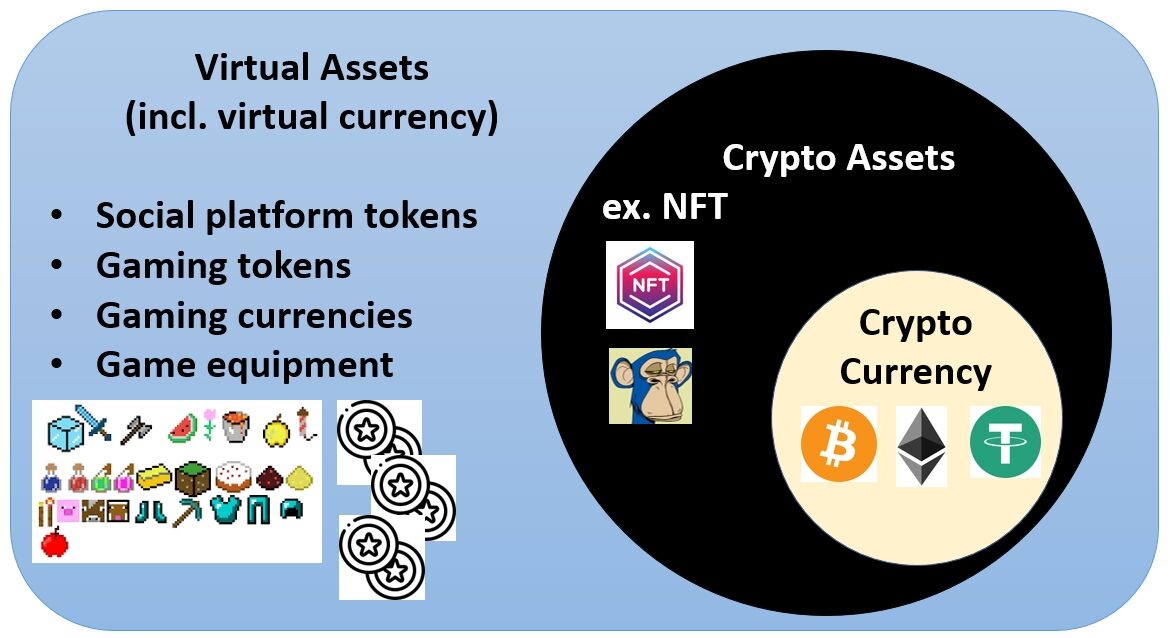

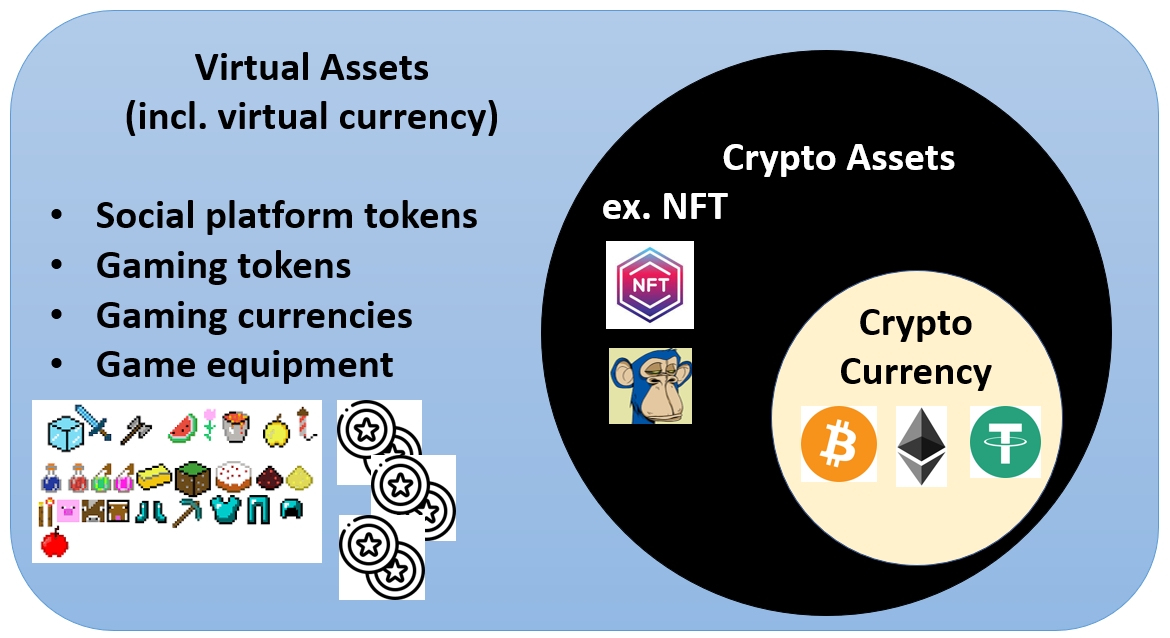

台灣主管機關在描述各種情況下的加密資產時,使用不同但相似的術語,例如“虛擬貨幣”和“數位資產”。 這些術語的字面含義可能不僅包括去中心化區塊鏈技術產生的加密資產和貨幣,還包括僅在封閉和中心化系統中有效和可轉移的數位存儲資產,例如網絡遊戲的代幣和設備 、營銷網站和社交平台。 雖然“虛擬貨幣”一詞已經有了適用於比特幣、以太坊和 USDT 等加密貨幣的法律定義,以用於反洗錢目的,但法院在涉及電腦遊戲詐欺的民刑案件之中,也使用了”虛擬貨幣”一詞,來裁決一個玩家應將該遊戲的一定數量的代幣/金錢轉移給其他受騙的玩家。

研議中的加密資產分立監管

由於台灣主管機關對加密資產的理解至今僅限於加密貨幣和非同質性代幣(NFT),它們也符合加密資產的經典定義,[FN1]本文也採用相同範圍的加密資產來說明 討論其相應的稅捐待遇。 在關注稅收之前,具有不同行政職責和目的的各個部門也分享不同的角度和想法,這可能有助於我們更好地描繪台灣監管環境中加密資產的圖景/預測。

據金管會證實的新聞報導[FN 2],有一項立法提案將加密資產分為穩定幣、穩定幣以外的加密貨幣和NFT三類,分別由中央銀行、金管會和數位發展部部 (“MDA”)管理。 但是,尚未發布明確的時間表或立法議程。

不同主管機關的不同視角和理解

至於處理加密資產的當局,有金管會、中央銀行、法務部、數字事務部、刑事和民事法庭。 他們每個單位都有不同的觀點和理解:

1. 金管會和中央銀行:這兩個機構旨在維持金融市場秩序並保護投資者。 如上所述,在任何有效監管之前,這兩個機構對加密資產持懷疑態度,並將其視為高度不穩定和投機的投資工具,這似乎是很合理的。

2.司法部:該機構的任務是充當反洗錢和反腐敗的守門人。 在 2022 年將加密貨幣交易所納入反洗錢法規後,司法部正在擴大申報範圍,以加密貨幣形式申報高級官員的個人資產,[FN3] 如果官員未能相應遵守,將被處以巨額罰款。

3. 數位發展部:貨幣和投資用途以外的加密資產由數位發展部監管。 這裡典型的資產類型是 NFT 和 IP 地址。 MDA 部長表示,他們監管的加密資產並不總是像 FSC 和中央銀行聲稱的那樣具有風險。 更靈活的立法立場可能會在創新和消費者保護之間取得平衡。 [FN4]

4. 刑事法庭:加密資產,尤其是比特幣,已被用作販毒和洗錢的常見支付手段,[FN5] 並且加密資產被認為是一種有資格沒收犯罪收益的有價值的財產,[FN6] 和符合非法吸金的存款要件。

5. 民事法庭:台灣民事法庭長期以來一直承認加密資產,尤其是比特幣,是購買契約和消費借貸契約的有價值和合格的契約標的。[FN7]